The Investment Decisions are a core area essential to strategic planning and financial management. You’ll examine capital budgeting techniques, including net present value, internal rate of return, and payback period, to assess potential investments. This section covers risk analysis, cost of capital, and the evaluation of long-term financial projects.

Capital Budgeting

Investments in assets are usually made with the intention to generate revenue or reduce costs in future. The reduction in cost is considered equivalent to increase in revenues and should, therefore, be treated as cash inflow in capital budgeting computations. Calculating NPV involves computing the present value of each cash flow and then summing the present values of all cash flows from the project. This project has six future cash flows, so six present values must be computed. On the other hand, if your initial investment figure is higher than the total of the present value of future cash, you have a negative net present value. The value of current cash inflows is known, certain and it has the potential to make a return.

- The final result is that the value of this investment is worth $61,446 today.

- To account for the risk, the discount rate is higher for riskier investments and lower for a safer one.

- The profitability index is the ratio of the present value of cash inflows to the present value of cash outflows.

- He also doesn’t know for sure that he will be able to generate $20,000 of additional revenue from this piece of equipment year over year.

- Connect to your warehouse, semantic layer, and hundreds of service APIs to put data analysis and dashboards into the hands of business users.

Net Present Value (NPV): Definition, Examples & Calculation

NPV is a more accurate and comprehensive measure of returns than the payback period, considering important factors such as inflation, tax rates, and the present value of future cash flows. It also allows for easier comparison between investments with different durations or risk profiles. The NPV method solves several of the listed problems with the payback period approach. All of the cash flows are discounted back to their present value to be compared. Projects with a positive NPV should be accepted, and projects with a negative NPV should be rejected.

Facilitates Comparison of Investment Alternatives

NPV is a more accurate and comprehensive measure of returns than the payback period. If you are looking for a precise estimate of returns, then NPV is the preferred financial metric. By calculating the NPV and IRR of a project, you can make better decisions about whether to invest in it. If both values are positive, the project will generate a positive return on investment. By calculating the NPV of a project or investment, you can determine whether it’s likely to yield positive returns. Smart Manufacturing Company is planning to reduce its labor costs by automating a critical task that is currently performed manually.

Example 4 – choosing among several alternative projects

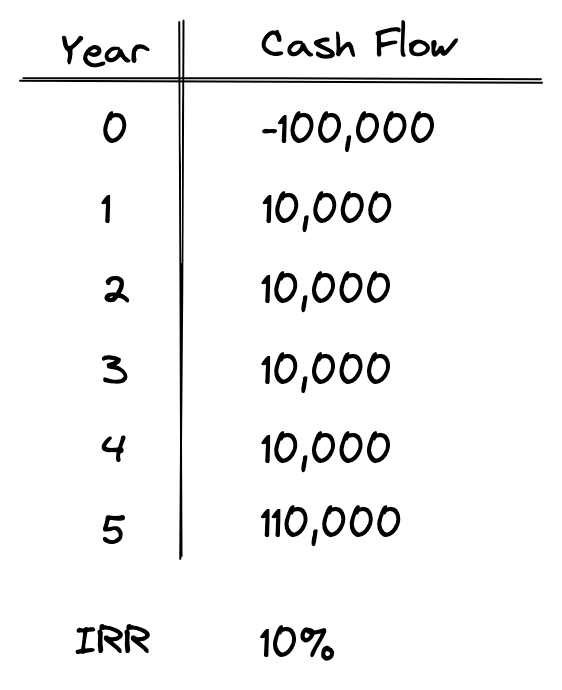

To account for the risk, the discount rate is higher for riskier investments and lower for a safer one. The US treasury example is considered to be the risk-free rate, and all other investments are measured by how much more risk they bear relative to that. The first point (to adjust for risk) is necessary because not all businesses, projects, or investment opportunities have the same level of risk. 4 inventory costing methods for small businesses Put another way, the probability of receiving cash flow from a US Treasury bill is much higher than the probability of receiving cash flow from a young technology startup. For example, IRR could be used to compare the anticipated profitability of a three-year project with that of a 10-year project. Net present value is even better than some other discounted cash flow techniques such as IRR.

This method can be used to compare projects of different time spans on the basis of their projected return rates. The full calculation of the present value is equal to the present value of all 60 future cash flows, minus the $1 million investment. The calculation could be more complicated if the equipment were expected to have any value left at the end of its life, but in this example, it is assumed to be worthless.

And the outcome couldn’t be simpler – the investment with the highest Net Present Value is the most likely to give you a good return on your initial cost. But it does need initial definitions of its component parts, so it makes sense. Here are the other terms you need to get to the Net Present Value calculation. Comparing NPVs of projects with different lifespans can be problematic, as it may not adequately account for the difference in the duration of benefits generated by each project.

Inaccurate projections can lead to misleading NPV results and suboptimal decision-making. A zero NPV implies that the investment or project will neither generate a net gain nor a net loss in value. In this situation, decision-makers should carefully weigh the risks and potential benefits of the investment or project before making a decision. Below is a break down of subject weightings in the FMVA® financial analyst program. As you can see there is a heavy focus on financial modeling, finance, Excel, business valuation, budgeting/forecasting, PowerPoint presentations, accounting and business strategy.

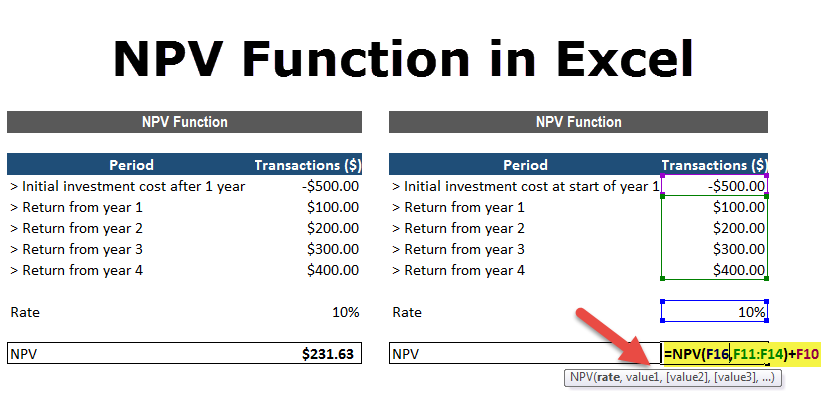

If you need to be very precise in your calculation, it’s highly recommended to use XNPV instead of the regular function. This means that you’ll make more in this investment than you would on interest if you put the same amount of money in the bank. As it stands, this leaves an overall return of £50,000 on your £100,000 investment. You might find it useful if you’re working out whether or not to invest in new equipment for your business. The period from Year 0 to Year 1 is where the timing irregularity occurs (and why the XNPV is recommended over the NPV function). For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing.

It is sensitive to changes in estimates for future cash flows, salvage value and the cost of capital. NPV analysis is commonly coupled with sensitivity analysis and scenario analysis to see how the conclusion changes when there is a change in inputs. If the expected cash flows in either example had been negative, the NPV would have been negative, indicating that the project would likely yield a negative return investment. In this example, the NPV is $4,442, which means the project is expected to generate a return of $1,442 more than the initial investment of $3,000. The basic advantage of net present value method is that it considers the time value of money while evaluating the proposals’ viability.

Net Present Value is an accounting calculation that’s used to help make decisions about investments. It’s more useful than some other investment indicators because it takes the ‘time value of money’ into account. Unlike the NPV function in Excel – which assumes the time periods are equal – the XNPV function takes into account the specific dates that correspond to each cash flow. Performing NPV analysis is a practical method to determine the economic feasibility of undertaking a potential project or investment. The present value (PV) of a stream of cash flows refers to the value of the future cash flows as of the current date. The discount rate used in NPV calculations is a critical factor in determining the result.